The radio industry remains cautiously optimistic while ramping up offerings to keep brands invested in the medium The last few years have been all about touch and feel. However, the pandemic has shown us how technology and innovations can move into uncharted waters and still survive. Radio, for one, was hit hard this year with advertisers staying away during the early months of the pandemic and the ensuing lockdown. Now as most services and businesses are up and running, the industry maintains a cautiously optimistic outlook as it gears up for a revival. The way we consume audio is rapidly changing, right from music to talk and from podcasts to audio stories. While the face of audio might well be changing with the advent of myriad audio streaming platforms and apps, Radio continues to hold its own in the country on the back of its cost-effective reach, customised touch, easy accessibility and propensity for localisation. The big question is – will the sector see recovery by the end of this year, and rule the airwaves again?

Speaking of the consumer driven sectors such as auto and retail which contributed significantly to the fall in FEVER FM’s advertising revenues, Harshad Jain, CEO, Radio & Entertainment, HT Media Ltd & Next Mediaworks Ltd says, “The unexpected coronavirus pandemic has further deepened the crisis with major cuts in advertising across all industries and services, including travel and entertainment sectors.”

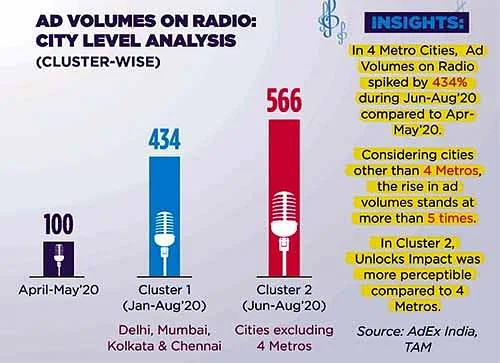

Although radio listenership saw a good amount of consumption and relative increase in the audiences in the April-June quarter, unlike Print and OOH, its ad spends saw a significant downturn. “This is the reason radio might see an overall 30-35% drop by the end of 2020. The festive period will be quite important even for Radio from the spends’ perspective,” states Anand Bhadkamkar, CEO India, dentsu.

Q1 of 20-21 for all radio players was clearly the worst, although market sentiments on global and local factors were overall moderate before COVID-19 hit. Red FM too, witnessed a decline of close to 85% in revenues post COVID, albeit the business was already down in the range of 10-15%. “While the time spent listening to radio and radio as a trusted medium soared, capitalising the same could not be done due to the macro factors.

The biggest damage it did, was on the yields which were brought down to help and facilitate financially crunched advertisers initiate some momentum in the advertising,” points out Nisha Narayanan, Director & COO, Red FM and Magic FM, adding that it is now crucial for the industry to move much closer to pre-COVID yields in order to improve both its top-line and bottom-line.

Speaking of the consumer driven sectors such as auto and retail which contributed significantly to the fall in FEVER FM’s advertising revenues, Harshad Jain, CEO, Radio & Entertainment, HT Media Ltd & Next Mediaworks Ltd says, “The unexpected coronavirus pandemic has further deepened the crisis with major cuts in advertising across all industries and services, including travel and entertainment sectors.”

Although radio listenership saw a good amount of consumption and relative increase in the audiences in the April-June quarter, unlike Print and OOH, its ad spends saw a significant downturn. “This is the reason radio might see an overall 30-35% drop by the end of 2020. The festive period will be quite important even for Radio from the spends’ perspective,” states Anand Bhadkamkar, CEO India, dentsu.

Q1 of 20-21 for all radio players was clearly the worst, although market sentiments on global and local factors were overall moderate before COVID-19 hit. Red FM too, witnessed a decline of close to 85% in revenues post COVID, albeit the business was already down in the range of 10-15%. “While the time spent listening to radio and radio as a trusted medium soared, capitalising the same could not be done due to the macro factors.

The biggest damage it did, was on the yields which were brought down to help and facilitate financially crunched advertisers initiate some momentum in the advertising,” points out Nisha Narayanan, Director & COO, Red FM and Magic FM, adding that it is now crucial for the industry to move much closer to pre-COVID yields in order to improve both its top-line and bottom-line.

“By the end of the year we should see an estimated growth as compared to the current situation. 2021 will definitely be much better”, observes Jai Lala, COO, Zenith. However, Yatish Mehrishi, COO, ENIL anticipates a drop in revenue this financial year, primarily because of the loss suffered in H1, which according to them will make recovery hard in H2.

TOWARDS BROADER HORIZONS

Through all the hardships brought forth by daunting times, Radio has managed to stay afloat, but players are well aware of their need to level up and are now going beyond just radio and operate as a holistic audio entertainment company. As an early mover into the solutions space, Radio Mirchi has had a big focus on brand solutions which contributed to 35% of its overall revenue last year. “We believe that it will account for 55-60% of our overall revenues in the next five years.

The pandemic propelled diverse preferences of clients for solutions and we used this period to do extensive training of all our teams on ideating, designing and selling solutions to clients.

Over the years, we have grown our digital footprint, which includes YouTube and social media across different digital platforms, and also built capabilities of our online audio/video production teams. We now leverage our digital strengths as a key element for providing solutions for our clients,” Mehrishi of Radio Mirchi elaborates.

Big FM, on the other hand, signed up over 20 partnerships where its clients can get a potential audience reach of 15 crore. “Our focus will be on adding incremental reach through multiple touch points.

We are creating a large volume of timeless non-music content, which can now be consumed as podcasts on audio streaming platforms to newer audiences, expanding the reach of our powerful content IP’s,” says Thomas of Reliance Broadcast Network Limited. Similarly, Radio City is adopting a multi-faceted approach by using RJs as influencers to talk about brands.

“We started out with our campaign ‘Radio City Bazaar’, where micro entrepreneurs can talk about their brands to RJs on this platform and reap the benefits of having a larger audience”, Kukian of Radio City says, adding that there would be no compromise on the revenues to these entrepreneurs, but more delivery on the value front.

Since plain vanilla advertising can no longer suffice, players are also looking at other forms of revenue to attain next level growth. Speaking about their plans to augment Fixed Commercial Time (FCT), Jain of HT Media Ltd & Next Mediaworks Ltd believes that innovation, brand integration and providing out of the box solutions to the client’s need is going to be of top most priority, both on the radio and digital assets.

“One of the primary focus areas for us is to adopt a digital-first and platform-agnostic approach and the other one at this time, would be to leverage our most important assets, our employees to their full potential. Capability building, upskilling and talent nurturing will the key focus areas in this regard,” he adds. Red FM’s crew have been busy exploring new markets to horizontally expand its client base.

With a focus on digital, podcasts, content monetisation, it has got some of its IPs the same success, as on-ground. “Our podcasts are creating an ecosystem wherein our partners will be getting value for money from us with better reach in the long term,” says Narayanan of RED FM.

Having an already strong digital-media presence, MY FM is leveraging its strength to shift its events to digital platforms.

TIER 2 AND 3 MARKETS: PROPELLING RECOVERY

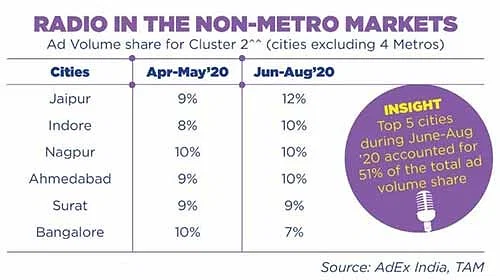

Although local brands were dealt the biggest blow in the lockdown, metros faced far more challenges that Tier 2 and Tier 3 markets. In fact, local markets did surprisingly well and are likely to reach pre-COVID levels much sooner than the metros. As per the recent TAM AdEx Report, the top five non-metro cities; Jaipur, Indore, Nagpur, Ahmedabad and Surat accounted for 51% of total ad volume share between June and August, 2020.

Talking about the local mass-reach, insights, and influence which plays a huge role in the industry bouncing back to the path of recovery, Thomas says, “Categories like BFSI, auto, FMCG, consumer non-durables and e-commerce have always done well and propelled us to a speedy recovery.

Health care, Pharma and Ayurvedic products have seen increased demands and there has been an unprecedented number of new launches in the FMCG space and most of them being local, radio is seeing a lot of activity.” Brands prefer a one-stop, 360-degree localised campaign to leverage their presence across multiple touch points and this is where it can leverage the high local reach of radio. “Radio has been a vital part of our communication since day one.

Its reach is across all age groups and people tune in usually during travelling time. Even now as the lockdown is lifted in certain places, we started our radio campaign around the first week of October,” explains Rima Kirtikar, Chief Marketing Officer of Viviana Mall, which houses over 250 brands, including local ones. Radio City receives 40% of its revenue from local markets, which are already on the path to a 100% recovery.

Speaking about the role of smaller markets in recovery, Red FM’s Narayanan notes, “Local brands were able to replenish the shelves faster than their MNC or national competitors. That helped them to get sampled more, create more demand and shelf value on shops for them and make some good monies, which they can now invest in expanding their manufacturing, marketing and distribution. Mehrishi of Mirchi also states that 50% of its business comes from local markets.

“With an array of content available in these markets, and in their local language, their resonance and love towards Mirchi is much stronger. This is also one of the most appealing features that pull in business for brand solutions,” he adds.

Brands, however, local or otherwise, have always trusted Radio as a feasible medium, with last mile connectivity and reach. FMCG, BFSI, home decor and many other categories have been active on the medium. “Given the seasonality and nature of business, Q4 of every FY is a very important for a life insurance company.

Radio has not only had a good impact for us in Category A & B cities, but also helped us connect with audiences across deeper and remote locations,” explains Sonia Notani, CMO, Indiafirst Life. Kirtikar of Viviana Mall too, states that there hasn’t been a single campaign in which they haven’t included Radio.

“The medium has delivered effectively, and it has indeed become one of the preferred mediums for our campaigns, helping us converse with a larger set of audience. We also have new campaigns in the pipeline where radio will play a major role,” a Mother Dairy spokesperson says.

Speaking of radio’s value in a brand’s media-mix, Bhadkamkar says, “It works out quite cost-effective and avoids any kind of wastage. Moreover, it can also carry out real-time campaigns with direct conversations with RJs and interactions live on air from the event location. To be honest, radio has multiple benefits for consideration.”

The propensity that Radio offers for offline engagement and activations is also another big asset for advertisers. While most radio players are adopting a wait-and-watch approach when it comes to activations, a few players have already started to take baby steps.

Talking about the same, Rahul Namjoshi, COO, MY FM states, “We are currently doing a Pan-Punjab activity for Samsung, likewise in Gujarat, we are doing society activations for the festive season. All this is getting executed after clearly ensuring everyone’s safety and keeping the government regulations in mind.”

Although consumer fear still lingers, players agree that it is only a matter of time before consumer confidence is restored and activations can resume. “We have to keep encouraging people to step out of their houses, as a part of our effort to restart the economy.

Local businesses need our support more than ever and we must continue to embrace the new normal way of operating,” notes Mehrishi of Radio Mirchi.

A FUTURE OF INTEGRATION

In India, the increase in radio broadcasting has resulted in an increase in radio listening and is growing year-on-year. “The market for speech and voice recognition is set to grow to 40.47% to reach `210.63 crore by end of 2020 as per an industry report.

Voice technology has disrupted local search, mobile search and the Internet of Things (IoT) with the advent of wearables and digital assistants,” notes Mohit Joshi, CEO, Havas Media Group India. Although radio will be a vital form of communication for brands and a stress buster for consumers, it will see stiff competition from audio streaming apps. “The advent of players like Spotify, and other digital radio stations is a challenge, since it is going to create more inroads, due to its accessibility,” Lala of Zenith added.

“Millennials are choosing music apps such as Spotify, Saavn and YouTube Music and hence, digital integration could be the key to get better bang for buck for brands. Radio channels could focus on RJ following on social media to increase engaged audience,” says Rajeev GN, VP, Marketing, HomeLane.

However, while radio can amplify activations, digital might not be able to do the same. “The biggest difference between FM players and music apps is the vocalised connect which the RJ brings. It’s only a matter of time until digital apps do that. Even then, it’s not easy because Radio is more lively and it is not certain how Digital is just going to turn it around,” Lala added.

Adding to its scope, Notia of Indiafirst Life believes that there are many content opportunities for Radio, in addition to running regular ads. “Depending on the message and purpose of the campaign, there can be integration with existing properties. Alternatively, the alignment of interests can be achieved with existing programming dynamics.”

“HD Radio is well poised to disrupt the market in India. Radio would encompass podcast and live streaming largely and would sync more with digital radio in the next few years”, adds Bhadkamkar.

The connect with listeners and consumers that radio offers is something both brands and radio players should capitalise on, while exploring integrations on Digital platforms. “Brands that depend on footfalls, visits and walk-ins are definitely to continue spending on Radio.

The likes of auto, FMCG, insurance, banks, NBFCs, retail and durables will continue spending on this medium, especially with smaller town focus,” Parashar of GroupM points out.

Since the medium is almost back on track in terms of volume, Q1 of next year should have good news in terms of revenue.

“By the end of the year we should see an estimated growth as compared to the current situation. 2021 will definitely be much better”, observes Jai Lala, COO, Zenith. However, Yatish Mehrishi, COO, ENIL anticipates a drop in revenue this financial year, primarily because of the loss suffered in H1, which according to them will make recovery hard in H2.

TOWARDS BROADER HORIZONS

Through all the hardships brought forth by daunting times, Radio has managed to stay afloat, but players are well aware of their need to level up and are now going beyond just radio and operate as a holistic audio entertainment company. As an early mover into the solutions space, Radio Mirchi has had a big focus on brand solutions which contributed to 35% of its overall revenue last year. “We believe that it will account for 55-60% of our overall revenues in the next five years.

The pandemic propelled diverse preferences of clients for solutions and we used this period to do extensive training of all our teams on ideating, designing and selling solutions to clients.

Over the years, we have grown our digital footprint, which includes YouTube and social media across different digital platforms, and also built capabilities of our online audio/video production teams. We now leverage our digital strengths as a key element for providing solutions for our clients,” Mehrishi of Radio Mirchi elaborates.

Big FM, on the other hand, signed up over 20 partnerships where its clients can get a potential audience reach of 15 crore. “Our focus will be on adding incremental reach through multiple touch points.

We are creating a large volume of timeless non-music content, which can now be consumed as podcasts on audio streaming platforms to newer audiences, expanding the reach of our powerful content IP’s,” says Thomas of Reliance Broadcast Network Limited. Similarly, Radio City is adopting a multi-faceted approach by using RJs as influencers to talk about brands.

“We started out with our campaign ‘Radio City Bazaar’, where micro entrepreneurs can talk about their brands to RJs on this platform and reap the benefits of having a larger audience”, Kukian of Radio City says, adding that there would be no compromise on the revenues to these entrepreneurs, but more delivery on the value front.

Since plain vanilla advertising can no longer suffice, players are also looking at other forms of revenue to attain next level growth. Speaking about their plans to augment Fixed Commercial Time (FCT), Jain of HT Media Ltd & Next Mediaworks Ltd believes that innovation, brand integration and providing out of the box solutions to the client’s need is going to be of top most priority, both on the radio and digital assets.

“One of the primary focus areas for us is to adopt a digital-first and platform-agnostic approach and the other one at this time, would be to leverage our most important assets, our employees to their full potential. Capability building, upskilling and talent nurturing will the key focus areas in this regard,” he adds. Red FM’s crew have been busy exploring new markets to horizontally expand its client base.

With a focus on digital, podcasts, content monetisation, it has got some of its IPs the same success, as on-ground. “Our podcasts are creating an ecosystem wherein our partners will be getting value for money from us with better reach in the long term,” says Narayanan of RED FM.

Having an already strong digital-media presence, MY FM is leveraging its strength to shift its events to digital platforms.

TIER 2 AND 3 MARKETS: PROPELLING RECOVERY

Although local brands were dealt the biggest blow in the lockdown, metros faced far more challenges that Tier 2 and Tier 3 markets. In fact, local markets did surprisingly well and are likely to reach pre-COVID levels much sooner than the metros. As per the recent TAM AdEx Report, the top five non-metro cities; Jaipur, Indore, Nagpur, Ahmedabad and Surat accounted for 51% of total ad volume share between June and August, 2020.

Talking about the local mass-reach, insights, and influence which plays a huge role in the industry bouncing back to the path of recovery, Thomas says, “Categories like BFSI, auto, FMCG, consumer non-durables and e-commerce have always done well and propelled us to a speedy recovery.

Health care, Pharma and Ayurvedic products have seen increased demands and there has been an unprecedented number of new launches in the FMCG space and most of them being local, radio is seeing a lot of activity.” Brands prefer a one-stop, 360-degree localised campaign to leverage their presence across multiple touch points and this is where it can leverage the high local reach of radio. “Radio has been a vital part of our communication since day one.

Its reach is across all age groups and people tune in usually during travelling time. Even now as the lockdown is lifted in certain places, we started our radio campaign around the first week of October,” explains Rima Kirtikar, Chief Marketing Officer of Viviana Mall, which houses over 250 brands, including local ones. Radio City receives 40% of its revenue from local markets, which are already on the path to a 100% recovery.

Speaking about the role of smaller markets in recovery, Red FM’s Narayanan notes, “Local brands were able to replenish the shelves faster than their MNC or national competitors. That helped them to get sampled more, create more demand and shelf value on shops for them and make some good monies, which they can now invest in expanding their manufacturing, marketing and distribution. Mehrishi of Mirchi also states that 50% of its business comes from local markets.

“With an array of content available in these markets, and in their local language, their resonance and love towards Mirchi is much stronger. This is also one of the most appealing features that pull in business for brand solutions,” he adds.

Brands, however, local or otherwise, have always trusted Radio as a feasible medium, with last mile connectivity and reach. FMCG, BFSI, home decor and many other categories have been active on the medium. “Given the seasonality and nature of business, Q4 of every FY is a very important for a life insurance company.

Radio has not only had a good impact for us in Category A & B cities, but also helped us connect with audiences across deeper and remote locations,” explains Sonia Notani, CMO, Indiafirst Life. Kirtikar of Viviana Mall too, states that there hasn’t been a single campaign in which they haven’t included Radio.

“The medium has delivered effectively, and it has indeed become one of the preferred mediums for our campaigns, helping us converse with a larger set of audience. We also have new campaigns in the pipeline where radio will play a major role,” a Mother Dairy spokesperson says.

Speaking of radio’s value in a brand’s media-mix, Bhadkamkar says, “It works out quite cost-effective and avoids any kind of wastage. Moreover, it can also carry out real-time campaigns with direct conversations with RJs and interactions live on air from the event location. To be honest, radio has multiple benefits for consideration.”

The propensity that Radio offers for offline engagement and activations is also another big asset for advertisers. While most radio players are adopting a wait-and-watch approach when it comes to activations, a few players have already started to take baby steps.

Talking about the same, Rahul Namjoshi, COO, MY FM states, “We are currently doing a Pan-Punjab activity for Samsung, likewise in Gujarat, we are doing society activations for the festive season. All this is getting executed after clearly ensuring everyone’s safety and keeping the government regulations in mind.”

Although consumer fear still lingers, players agree that it is only a matter of time before consumer confidence is restored and activations can resume. “We have to keep encouraging people to step out of their houses, as a part of our effort to restart the economy.

Local businesses need our support more than ever and we must continue to embrace the new normal way of operating,” notes Mehrishi of Radio Mirchi.

A FUTURE OF INTEGRATION

In India, the increase in radio broadcasting has resulted in an increase in radio listening and is growing year-on-year. “The market for speech and voice recognition is set to grow to 40.47% to reach `210.63 crore by end of 2020 as per an industry report.

Voice technology has disrupted local search, mobile search and the Internet of Things (IoT) with the advent of wearables and digital assistants,” notes Mohit Joshi, CEO, Havas Media Group India. Although radio will be a vital form of communication for brands and a stress buster for consumers, it will see stiff competition from audio streaming apps. “The advent of players like Spotify, and other digital radio stations is a challenge, since it is going to create more inroads, due to its accessibility,” Lala of Zenith added.

“Millennials are choosing music apps such as Spotify, Saavn and YouTube Music and hence, digital integration could be the key to get better bang for buck for brands. Radio channels could focus on RJ following on social media to increase engaged audience,” says Rajeev GN, VP, Marketing, HomeLane.

However, while radio can amplify activations, digital might not be able to do the same. “The biggest difference between FM players and music apps is the vocalised connect which the RJ brings. It’s only a matter of time until digital apps do that. Even then, it’s not easy because Radio is more lively and it is not certain how Digital is just going to turn it around,” Lala added.

Adding to its scope, Notia of Indiafirst Life believes that there are many content opportunities for Radio, in addition to running regular ads. “Depending on the message and purpose of the campaign, there can be integration with existing properties. Alternatively, the alignment of interests can be achieved with existing programming dynamics.”

“HD Radio is well poised to disrupt the market in India. Radio would encompass podcast and live streaming largely and would sync more with digital radio in the next few years”, adds Bhadkamkar.

The connect with listeners and consumers that radio offers is something both brands and radio players should capitalise on, while exploring integrations on Digital platforms. “Brands that depend on footfalls, visits and walk-ins are definitely to continue spending on Radio.

The likes of auto, FMCG, insurance, banks, NBFCs, retail and durables will continue spending on this medium, especially with smaller town focus,” Parashar of GroupM points out.

Since the medium is almost back on track in terms of volume, Q1 of next year should have good news in terms of revenue.