As per TAM AdEx-TV Year Rounder Report 2020, during the festive period, ad volumes on television witnessed double digit growth Year 2020 has been a difficult year for businesses across world, and broadcast industry is no different. While television witnessed an unprecedented spike in viewership this year, advertising could not enjoy the same momentum. The festive season though brought some cheers as the industry recorded its highest-ever advertising volume on television since Week 16 of 2015. As per BARC, 38.7 million seconds is the highest ever ad volume witnessed on television in Week 43. Advertising had saw a drop of 26% in the April- June period as compared to Q1 2020. As per the TAM AdEx- TV Year Rounder Report 2020, the average ad volume rose by 39% in the fourth quarter of the year 2020 compared to the average ad volume of the first three quarters. However, compared to year 2019, ad volumes saw a marginal rise of 0.8% this year.

The lockdown period also gave growth opportunity to other categories. For instance, the phase brought new advertisers and brands. Also, the year saw some new entrants like edu-tech brands under the education category.

Ecom-Media/Entertainment/Social Media among categories saw the highest increase in ad secondages with the growth of 70%, followed by Ecom-Education with 3.4 times growth during 2020 compared to 2019. In terms of growth percentage, the Hand Sanitizers category witnessed the highest growth among the Top 10 i.e. 19 times in 2020.

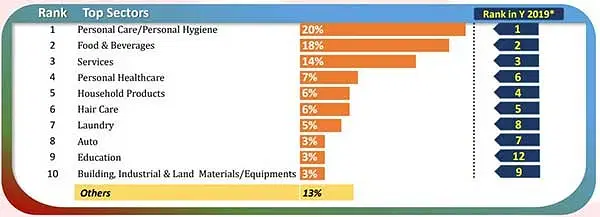

As per the report, the personal Care/Personal Hygiene sector had 20% share of ad volumes followed by F&B with an 18% share. Meanwhile, the top three sectors, which were also on top during the year 2019, together added 52% share of ad volumes. The education sector was the new entrant in the top 10 sectors’ list this year.

The lockdown period also gave growth opportunity to other categories. For instance, the phase brought new advertisers and brands. Also, the year saw some new entrants like edu-tech brands under the education category.

Ecom-Media/Entertainment/Social Media among categories saw the highest increase in ad secondages with the growth of 70%, followed by Ecom-Education with 3.4 times growth during 2020 compared to 2019. In terms of growth percentage, the Hand Sanitizers category witnessed the highest growth among the Top 10 i.e. 19 times in 2020.

As per the report, the personal Care/Personal Hygiene sector had 20% share of ad volumes followed by F&B with an 18% share. Meanwhile, the top three sectors, which were also on top during the year 2019, together added 52% share of ad volumes. The education sector was the new entrant in the top 10 sectors’ list this year.

While the toilet soaps category maintained its first position during the year 2020 with 7% share of ad volumes, Ecom-Media/Entertainment/Social Media moved up by five positions to achieve the second rank replacing Toilet/Floor Cleaners. Also, Rubs and Balms category was the only new entrant in the top 10 categories’ list.

Among the top advertisers of the year 2020, HUL topped the list followed by Reckitt. The top 10 advertisers together added a 45% share of ad volumes during the year. Colgate Palmolive India, Cadburys India and Amazon Online India were in the list of top 10 advertisers with a positive rank shift compared to the year 2019. GCMMF (Amul) was the new entrant in the Top 10 advertisers’ list.

While the toilet soaps category maintained its first position during the year 2020 with 7% share of ad volumes, Ecom-Media/Entertainment/Social Media moved up by five positions to achieve the second rank replacing Toilet/Floor Cleaners. Also, Rubs and Balms category was the only new entrant in the top 10 categories’ list.

Among the top advertisers of the year 2020, HUL topped the list followed by Reckitt. The top 10 advertisers together added a 45% share of ad volumes during the year. Colgate Palmolive India, Cadburys India and Amazon Online India were in the list of top 10 advertisers with a positive rank shift compared to the year 2019. GCMMF (Amul) was the new entrant in the Top 10 advertisers’ list.

In the top brands of 2020, Dettol Toilet Soaps led the top 10 list followed by Dettol Antiseptic Liquid. These top two brands from Reckitt Benckiser had almost the same share of ad volumes during 2020. As per the report, there was a total of 13,5000 brands present.

In the top brands of 2020, Dettol Toilet Soaps led the top 10 list followed by Dettol Antiseptic Liquid. These top two brands from Reckitt Benckiser had almost the same share of ad volumes during 2020. As per the report, there was a total of 13,5000 brands present.